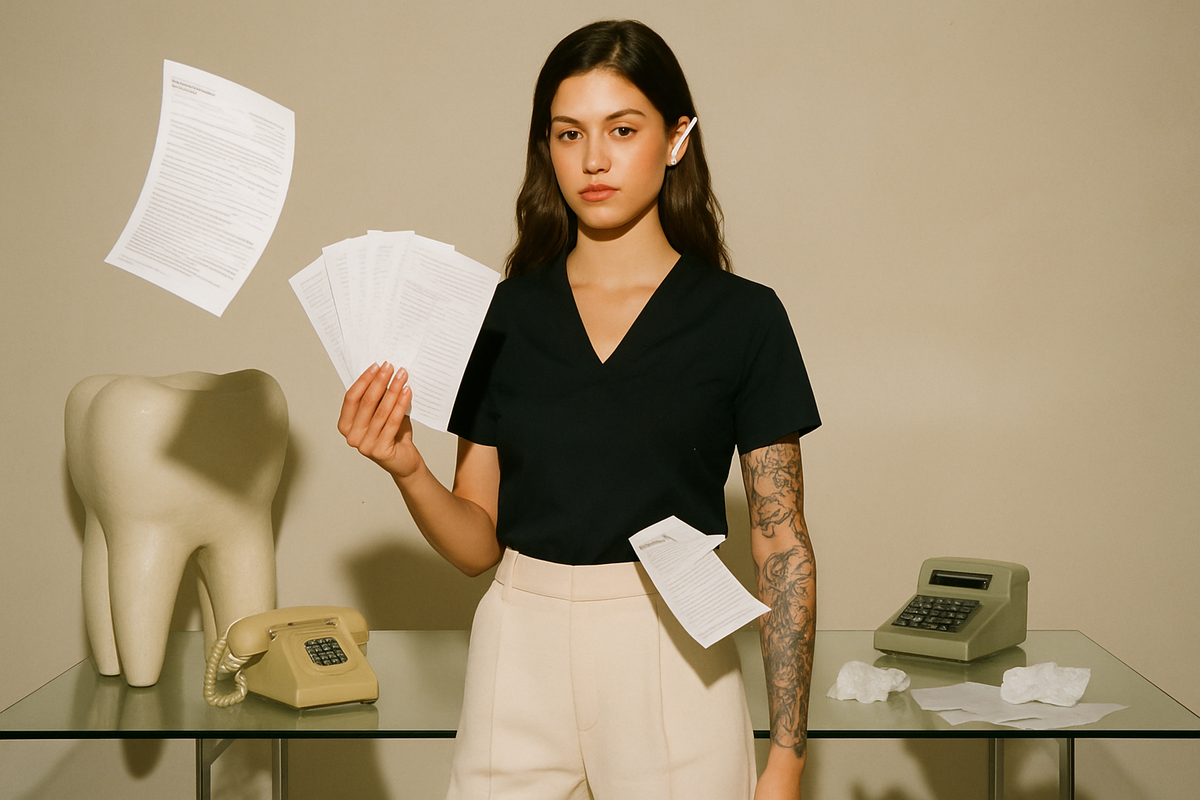

Is Dental Insurance a Source of Problems, Frustration, or Stress for Your Dental Practice?

By Shelbey Arevelo, BCPA

Dental insurance often presents challenges that can overwhelm dental practices—from delayed reimbursements to claim denials. The complexities of dental billing can turn what should be a smooth process into a source of stress, slowing down workflows and causing frustration for both staff and patients. However, with the right approach and systems in place, these headaches can be significantly reduced.

In this article, I’ll share insights from my experience in dental billing and consulting at Arevelo Elite Services, along with actionable tips to streamline your billing process—from the moment a patient calls to the final step of billing.

The Usual Pain Points

1. Confusing Insurance Policies

Different insurance providers have varying coverage policies and reimbursement rates, making it difficult to predict payments accurately.

2. Denied or Delayed Claims

Incomplete documentation or coding errors often result in denials, requiring time-consuming appeals.

3. Patient Communication

Explaining coverage limitations and out-of-pocket expenses can be difficult, leading to misunderstandings and dissatisfaction.

Tip 1: Streamline Insurance Verification at the Start of the Call

The first interaction with the patient—often over the phone or through an online booking system—sets the tone for the entire billing process. It’s essential to verify the patient’s insurance information during this initial contact.

How to Implement:

- Automate Verification: Use automated insurance verification tools that integrate with your practice management software. These tools pull patient insurance information in real-time, ensuring accuracy and saving your team time.

- Train Front Desk Staff: Ensure that your front desk team is trained to collect all necessary details, such as insurance policy numbers, group numbers, and plan types. Create a structured intake form to prevent missing key information.

Tip 2: Accurate Treatment Planning & Preauthorization

Once the patient is in your office, the treatment planning phase is critical for managing insurance coverage. It’s important to ensure the patient understands what their insurance will cover and what their financial responsibility will be.

How to Implement:

- Pre-Estimate Coverage: For complex treatments, send pre-treatment estimates to the insurance company. This helps provide a clear picture of coverage and prevents surprises.

- Use Precise Coding: Accurate coding is essential. Invest in training your team to stay updated on CDT code changes and ensure proper documentation for each date of service.

Tip 3: Claim Submission – Get It Right the First Time

One of the most time-consuming aspects of dental billing is claims processing. Submitting incorrect or incomplete claims leads to delays and denials, creating frustration for staff and patients.

How to Implement:

- Standardize Claim Submission: Make sure all required documentation—such as X-rays, periodontal charts, and narratives—is included with the claim. Missing attachments slow down processing time and delay payments.

- Use Electronic Claims: If you haven’t already, switch to electronic claim submission. It reduces errors and speeds up approval.

Tip 4: Post-Treatment Billing – Manage Patient Expectations

Once the insurance company processes the claim, it’s time to bill the patient for any remaining balance. Clear communication at this stage prevents misunderstandings.

How to Implement:

- Provide Detailed Statements: Share itemized statements that show exactly what insurance paid and what the patient owes.

- Offer Payment Plans: For larger balances, consider offering flexible payment plans or third-party financing. This boosts patient satisfaction and increases your chances of receiving full payment.

Tip 5: Managing the Claims Aging Report – Stay on Top of Unpaid Claims

One of the most important yet overlooked tools in dental billing is the Claims Aging Report. This report tracks insurance claims that haven’t been paid and categorizes them by how long they’ve been outstanding.

Typical Aging Categories:

- 0–30 days

- 31–60 days

- 61–90 days

- 91+ days

The older a claim is, the harder it is to collect. Consistent follow-up is crucial.

Common Issues Behind Aging Claims:

- Incomplete or Incorrect Information: Missing attachments, incorrect coding, or incomplete forms can result in rejections.

- Lack of Follow-up: Delayed follow-up lets claims get lost in the system.

- Insurance Company Delays: Some delays are on the insurer’s end, requiring persistent follow-up.

How to Stay Ahead:

- Run the Report Weekly: Make it a regular practice to run your Claims Aging Report once a week.

- Filter by Age: Prioritize claims approaching or exceeding the 30-day mark.

- Investigate Quickly: Claims in the 31–60 or 61–90-day range need immediate attention. A quick call or resubmission can often resolve the issue.

Implementation Tips:

- Assign a Team Member: Designate someone responsible for claim follow-ups. They should know how to communicate with insurers, check statuses, and handle appeals.

- Set Reminders: Use your practice management software to schedule follow-ups.

- Appeal Denied Claims Promptly: Don’t wait. Insurance companies often have strict timelines for appeals.

- Review Denial Codes: Understand the denial reason and correct any issues before resubmitting with a detailed explanation.

- Track Your Progress: Monitor how quickly claims are resolved after follow-up and look for trends. If one insurer is consistently slow, adjust your approach with them.

- Keep Patients Informed: If there’s a delay, keep patients in the loop. Transparency builds trust and prevents surprise bills later.

Tip 6: Monitor and Adjust Regularly

Billing is not a “set-it-and-forget-it” system. To keep operations running smoothly, you need ongoing oversight and improvement.

How to Implement:

- Track Key Metrics: Use your software to monitor claim approval rates, average payment times, and common denial reasons. These insights highlight areas for improvement.

- Continue Staff Training: Policies and coding requirements change frequently. Ongoing training ensures your admin team stays sharp and up-to-date.

From Stress to Strategy

With the right systems and support in place, dental insurance doesn’t have to be a headache. It can become a predictable, streamlined part of your practice's operations.

At Arevelo Elite Services, we help practices turn frustration into efficiency with personalized billing strategies and support.

Imagine smoother workflows, faster payments, and a confident, well-trained team. By mastering insurance processes, you’ll reduce stress and reclaim your time — all while enhancing patient care.